China Manufacturing "Second Half": Why Are Smart People Rushing to Seize Saudi Arabia’s Golden Window?

China Manufacturing “Second Half”: Why Are Smart Entrepreneurs Rushing to Seize Saudi Arabia’s Golden Window?

Vietnam? Indonesia? Bangladesh? Where is the best way “out to sea”?

These questions have become the daily anxiety of Chinese manufacturing bosses. But while most are still hesitating, some have already bypassed Southeast Asia, headed straight to Saudi Arabia—and quietly earned their first pot of gold.

Building factories in Jeddah, trial production within a year: fast land policies, short approval process—speed that crushes Southeast Asia.

Ultra-low 1% loan interest rates: Saudi Industrial Fund provides direct support, financing costs cut in half compared to China.

Government delivers orders to your door: photovoltaics, building materials, home appliances—once you land, you’re recommended to local buyers.

Some even joke: “In Saudi Arabia, you don’t chase opportunities—opportunities chase you.”

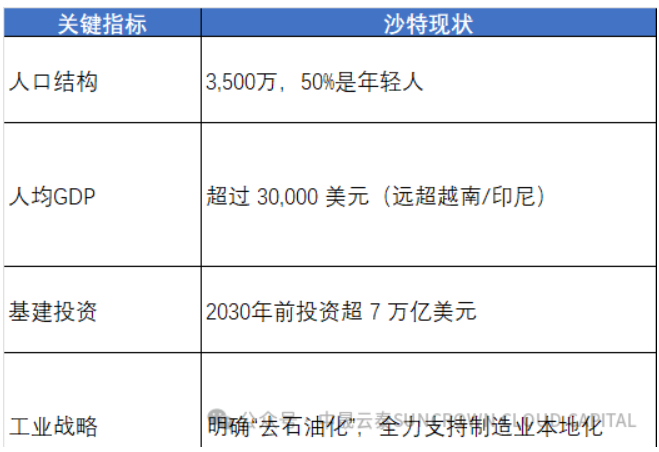

Why Saudi Arabia?

The answer in one sentence: Saudi is using “national power” to replicate the “China-style infrastructure miracle.”

Plenty of money: the Public Investment Fund (PIF) holds $700 billion, much of it directed at manufacturing.

Few people: local factories are scarce, competition almost zero, profit margins 30%+ higher than in Southeast Asia.

Aggressive policies: 10-year tax exemption, subsidized energy, land price locked for 30 years—government shoulders your costs.

More importantly, what Saudi wants is not just “investment,” but the entire industrial chain. From raw materials to finished products, as long as you relocate, they are ready to give money, land, and orders.

Saudi’s “Three Trump Cards” to Cure China’s “Overseas Headaches”

1. Money straight into your hands

The Saudi Industrial Development Fund (SIDF) operates with blunt force:

1–2% loan rates, covering up to 70% of project costs;

First 5 years repayment-free—essentially free start-up capital;

Loan approval even before production—sometimes the government is more impatient than you.

2. Costs cut to the bone

10-year corporate income tax exemption;

Electricity, water, and gas at a 70% discount;

Even land rent can be subsidized—first-year costs may be lower than in China.

3. Orders delivered by the government

Saudi law requires government procurement to prioritize local enterprises. As long as you register in MODON (Saudi industrial zones), orders in photovoltaics, auto parts, packaging materials, etc., are automatically open to you.

Why is the “window period” slipping away?

Saudi’s manufacturing boom is policy-driven, not organic market growth. Two key signals:

Land in prime parks such as Jeddah and Riyadh is running out—application thresholds will inevitably rise.

Saudi’s sector selection is tightening: photovoltaics, new energy, and advanced building materials are prioritized, while traditional industries like textiles are already being sidelined.

“Go now, and it’s gold mining. Go next year, and it may just be brick-laying.”

Three Steps to Land in Saudi and Get Ahead

Step 1: Fast industry screening

Check Saudi’s Industrial Strategy priority list (e.g., new energy, digitalization, automotive);

Work with local teams for compliance pre-checks (e.g., halal certification) to avoid pitfalls.

Step 2: Secure MODON land

Submit business plan + financial proof online;

Prioritize mature zones like Jeddah Phase II, Ras Al Khair Industrial City;

Asset-light firms can first rent factories (monthly rent as low as ¥8/m²).

Step 3: Maximize policy incentives

Apply for SIDF loans + industrial licenses simultaneously;

Use localization quotas (e.g., employing 30% Saudis) to unlock extra subsidies;

Expand from Saudi into six GCC countries plus Europe and North Africa.

Conclusion

Ten years ago, those who missed Southeast Asia regretted it. Five years ago, those who skipped Mexico kicked themselves. Today, Saudi’s policy dividends are right on the table—but the table is getting crowded.

The “second half” of manufacturing going global is no longer about “where is cheaper,” but about where dares to give you a future.